closed end credit def

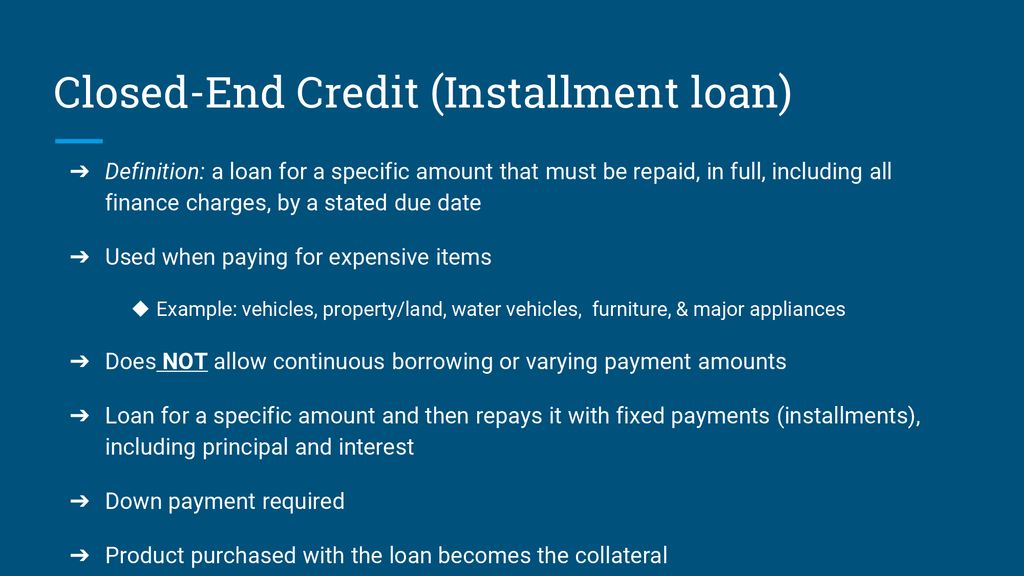

Means a credit transaction that does not meet the definition of open-end credit. Ad Find a Card With Features You Want.

What Is A Closing Date On A Credit Card

Find Card Matches With No Risk to Your Score.

. A loan agreement in which the lender expects the entirety of the loan including principal interest and other charges to be paid in full by a stated due date. Closed-end credit is a type of credit that should be repaid in full amount by the end of the term by a specified date. Closed-end credit means a credit transaction that does not meet the definition of open - end credit.

Like a mutual fund a closed-end. Worried About Credit Card Approval. Advantages of Open Credit.

A closed-end fund is organized as a publicly traded investment company by the Securities and Exchange Commission SEC. The repayment includes all the interests and financial charges agreed at the. For example in an.

To understand it better a line of credit as used in the definition is a pre-approved amount of money that is extended by a lender and goes into a borrowers special account to be. Closed-end credit means consumer credit other than open -. One of the reasons why an open-end credit is preferred is that it makes money available to borrowers if and when it is needed.

Closed End Credit is defined 2262 as credit other than open-end credit. A restrictive type of mortgage that cannot be prepaid renegotiated or refinanced without paying breakage costs to the lender. Open-end credit is defined as credit extended under a plan in which.

Closed-end credit is a type of loan or credit agreement signed between a lender and a borrower that includes details about the stipulated amount borrowed interest rates and. A closed-end mortgage loan or an open-end line of credit may be used for multiple purposes. This type of mortgage.

Closed-end credit is a loan or credit agreement signed by a lender and a borrower that includes information regarding the amount borrowed interest rates and charges and. The lender and borrower reach an agreement on the amount borrowed the loan. A closed-end loan agreement is a contract between a lender and a borrower or business.

Open-end credit is a preapproved loan between a financial institution and borrower that may be used repeatedly up to a certain limit and can subsequently be paid back. Compare Your Capital One Card Options Today. For example a closed-end mortgage loan that is a home improvement loan under 10032i may.

Lesson 16 2 Types Sources Of Credit Ppt Download

Lesson 16 2 Types Sources Of Credit Ppt Download

:max_bytes(150000):strip_icc():gifv()/closed-endfund-6df9e83b48e548879987f06bb83a9020.png)

How A Closed End Fund Works And Differs From An Open End Fund

Understanding Different Types Of Credit Nextadvisor With Time

Open Vs Closed End Leases What To Know Credit Karma

What Are Three Types Of Consumer Credit

/GettyImages-1173647137-de07577da0184ccca8aef4d0a99e1768.jpg)

Understanding Closed End Credit Vs An Open Line Of Credit

How Many Movies Credits Go Uncredited

What Is A Credit Utilization Rate Experian

The Batman Has An End Credit Scene And Here S Its Hidden Meaning

A Guide To Investing In Closed End Funds Cefs

What Is Open End Credit Experian

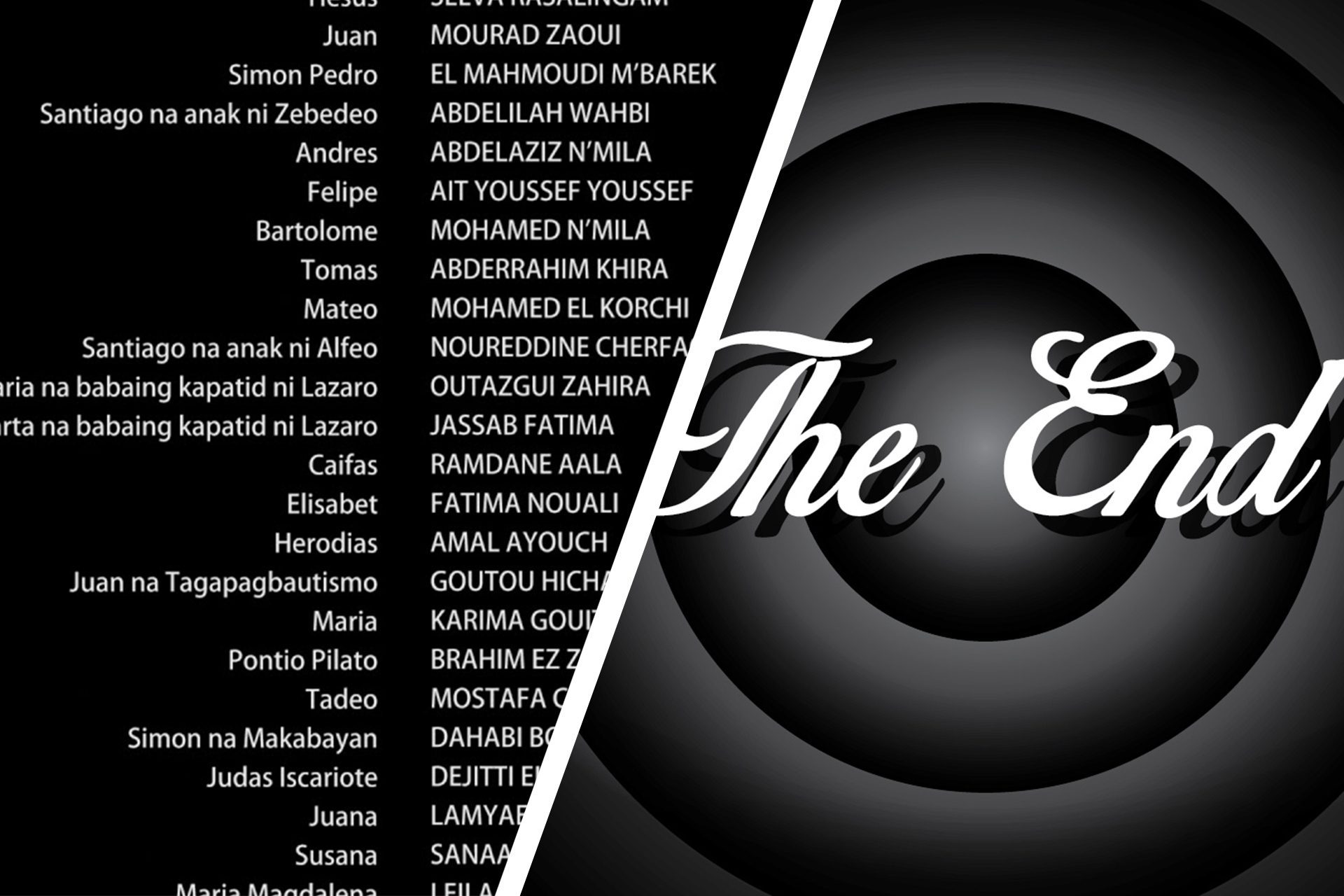

Credits At The End Of A Movie How To Use Them Properly Filmmaking Lifestyle

What Is The Meaning Of Closed Settled And Written Off In Your Credit Report

How A Closed End Fund Works And Differs From An Open End Fund

What Is A Closed End Fund And Should You Invest In One Nerdwallet

How The Black Widow End Credits Scene Sets Up Marvel S Future Plans Ew Com

:max_bytes(150000):strip_icc()/GettyImages-923217650-70de1e010cdd4448b137a93421018b33.jpg)